CPA Passing Score: The Ultimate Guide to Understanding Your Results

CPA Passing Score: The Ultimate Guide to Understanding Your Results

Introduction

It's the moment every future accountant dreads and dreams of: the score release. You refresh the NASBA portal, your heart pounding, looking for that one magic number. But what does a CPA passing score really mean? Why is 75 the benchmark? And how exactly does the American Institute of Certified Public Accountants (AICPA) calculate it?

If you think getting 75 means you answered 75% of the questions correctly, you're not alone—but you are incorrect. The CPA Exam scoring process is far more complex, involving "multi-stage testing" and weighted questions that measure your ability against a standard of foundational competency.

In this comprehensive guide, we'll strip away the confusion. We'll dive deep into the scoring mechanics, analyze what you need to pass each section (AUD, FAR, REG, and the Disciplines), and provide you with a strategy to ensure you're on the right side of the curve. Whether you're a first-time test-taker or retaking a section, this is the only guide you'll need to understand the numbers behind the license.

If you are still wondering is CPA worth it before diving into these numbers, the answer is a resounding yes for your career trajectory.

The Magic Number: What Logic Is Behind the 75?

The passing score for every section of the CPA Exam is 75 on a scale of 0 to 99.

This is not a percentage. It is a scaled score.

Think of it like standardized testing (SAT/ACT) but strictly for accountants. A score of 75 indicates that you have demonstrated the minimum knowledge and skills required to protect the public interest as a newly licensed CPA.

Percentile vs. Performance

Many candidates assume that the exam is graded on a curve. This is a myth. You are not competing against other test-takers; you are competing against a standard established by the AICPA Board of Examiners. Theoretically, if every single candidate met the standard one quarter, every single candidate would pass.

[Source: AICPA Scoring & Pass Rates]

How the CPA Exam is Scored: The Mechanics

The scoring process differs slightly depending on the testlets, but the core principle relies on Item Response Theory (IRT). This statistical framework weights questions based on their difficulty.

1. Multi-Stage Testing (MST)

The CPA Exam uses a dynamic structure for its Multiple-Choice Question (MCQ) testlets:

- Testlet 1: Always "Medium" difficulty.

- Performance Trigger: If you perform strongly on Testlet 1, Testlet 2 will be "Difficult." If you perform poorly, Testlet 2 will remain "Medium."

- The Benefit: Getting the "Difficult" testlet is actually a good thing. Difficult questions are weighted more heavily, giving you a higher potential score ceiling. It is mathematically harder (though not impossible) to pass if you get stuck in the "Medium" lane because you have less margin for error.

Visual content opportunity: A flowchart showing the path from Testlet 1 to either Medium or Difficult Testlet 2, illustrating how higher difficulty equals higher scoring potential.

2. Scoring Weights by Section (2025 Update)

With the CPA Evolution changes, the structure has shifted. Here is the current breakdown of how your score is calculated:

| Exam Section | Multiple-Choice Questions (MCQ) | Task-Based Simulations (TBS) |

|---|---|---|

| AUD (Auditing and Attestation) | 50% | 50% |

| FAR (Financial Accounting and Reporting) | 50% | 50% |

| REG (Regulation) | 50% | 50% |

| Disciplines (BAR, ISC, TCP) | 50% | 50% |

[!NOTE] Unlike previous versions of the exam where written communication mattered for BEC, the new Discipline sections are strictly split 50/50 between MCQ and TBS.

Deep Dive: Strategies for Each Section

Financial Accounting and Reporting (FAR)

FAR is often considered the beast of the CPA Exam due to the sheer volume of content.

- The Trap: Spending too much time on MCQs and rushing the Simulations.

- The Fix: Practice journal entries until they are second nature. The TBS portion heavily rewards candidates who can build financial statements from scratch.

Auditing and Attestation (AUD)

AUD is deceptive. The questions often have two "correct" answers, but one is the best answer.

- The Trap: Memorizing definitions without understanding application.

- The Fix: Focus on the assertion level. Understand why an auditor performs a specific procedure. A score of 74 in AUD is famously common because of the subjective nature of "judgment" questions.

Regulation (REG)

Tax law is black and white, but the calculations can get messy.

- The Trap: Getting bogged down in phase-out limits that change wildly every year.

- The Fix: Focus on the permanent rules of taxation (basis, basis, basis!). If you master entity taxation and property transactions, you are halfway to a 75.

What If You Fail? (Score < 75)

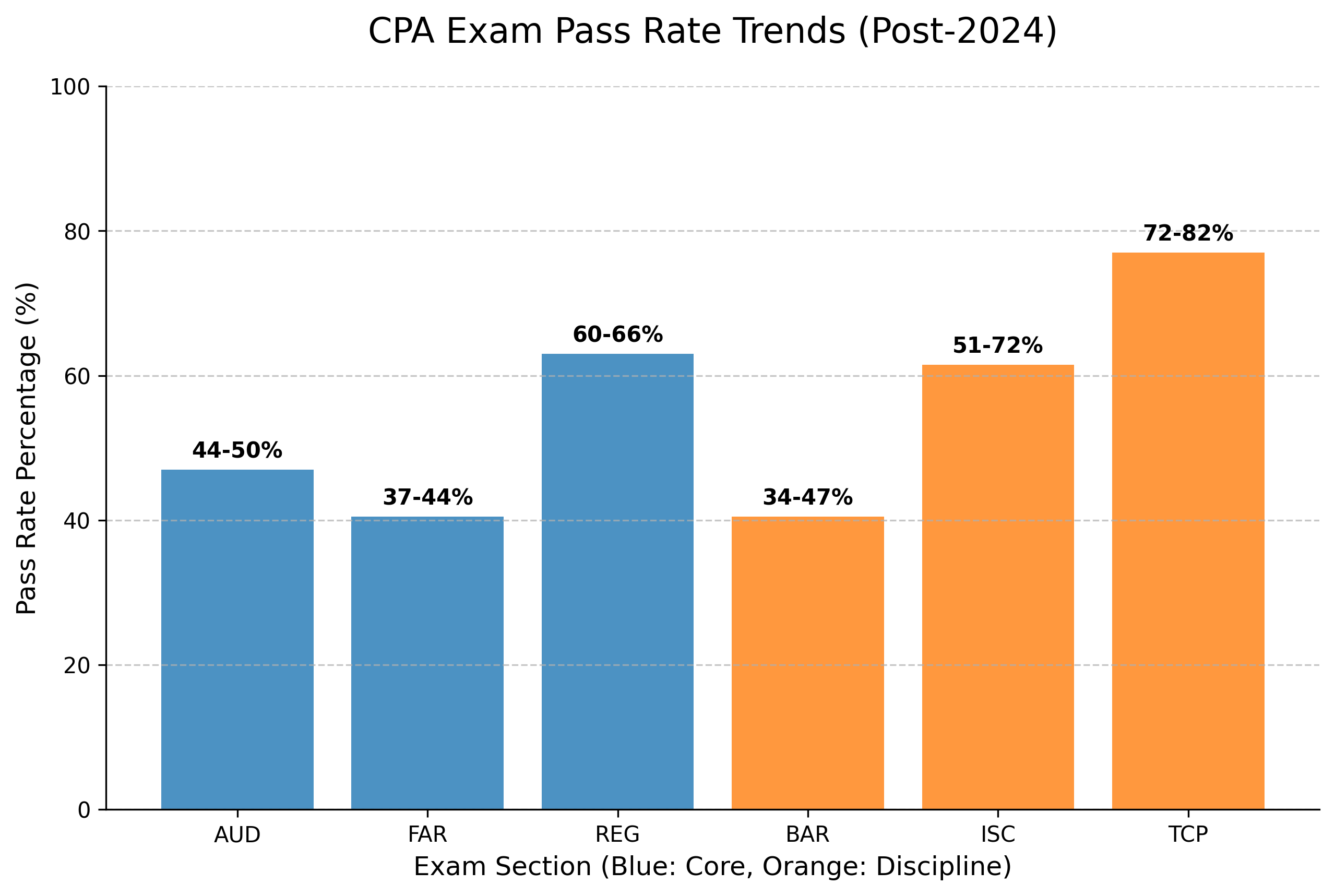

First, breathe. The average pass rate for the CPA Exam hovers around 45-50%. Failing is a normal part of the process.

Steps to Recover:

- Analyze Your Score Report: The NASBA report will tell you if you were "Weaker," "Comparable," or "Stronger" in specific content areas compared to passing candidates.

- Don't Start Over: If you scored between 65-74, you know the material. You just need to refine your weak spots. Focus on hammering out MCQs and Sims in your weak areas.

- Retake Fast: Don't let the information fade. Schedule your retake for 3-4 weeks out.

- Update Your Strategy: Sometimes it's about how you present your skills. While studying, ensure you know where to include certifications on your resume so you are ready to apply the moment you pass.

Visual Content Opportunities

To make this complex topic easier to digest, we recommend creating the following visual assets:

- The Road to 75 Flowchart: A visual representation of the Multi-Stage Testing model, showing how performing well on the first testlet leads to a "Difficult" second testlet and better scoring opportunities. Alt Tag: CPA Exam Multi-Stage Testing Flowchart showing medium vs difficult testlet scoring paths.

- Section Weighting Pie Charts: A simple graphical breakdown of the 50/50 MCQ vs. TBS split for all current Core and Discipline sections. Alt Tag: 2025 CPA Exam Structure Pie Chart showing 50% MCQ and 50% Simulations split.

Frequently Asked Questions

Is a 75 passing score hard to get?

Yes. The CPA Exam is designed to be difficult. It requires hundreds of hours of study. However, it is a test of discipline, not just intelligence. If you put in the time, a 75 is achievable.

Does the "CPA Curve" exist?

No. The AICPA explicitly states that there is no curve. You are scored against a standard, not against other students.

How are pre-test questions scored?

They aren't. Each exam section contains pre-test questions (both MCQ and TBS) that are being vetted for future exams. These do not count toward your score, but you won't know which ones they are, so treat every question as if it's real.

Conclusion

Understanding the CPA passing score is the first step toward conquering the exam. It’s not about being perfect; it’s about meeting the standard of competence expected of a professional. Don't obsess over getting a 90. In the accounting world, there is a saying: "What do you call a CPA who got a 75? A CPA."

Focus on your weak areas, manage your time on the Simulations, and trust the process.

Ready to land your dream accounting job after you pass? JobSeekerTools can help you optimize your resume and track your applications to ensure your hard-earned license leads to a high-paying career. Start your journey with us today.